China’s epic stock market boom—and impending bust—is like déjà vu all over again. The stock rally that began last year bears a striking resemblance to the credit-fueled American stock bonanza of the late 1920s. It also, however, has much in common with the Japanese market frenzy in the twilight of the 1980s. The uncanny similarities of both episodes also hint at what might await China when its market finally returns to reality.

Wall Street, 1929

Industry was pumping. Construction was booming. Dizzying leaps in technology were boosting living standards and giving rise to vibrant consumerism. That’s what set the scene to the epic American bull market of the late 1920s. But that description fits China of the last decade just as well. Here are some of the similarities between what’s happening now in China and the US in the lead-up to the epic Wall Street crash:

- Booming GDP. Industrial might built up during World War I and became the engine of American growth in the “roaring ’20s.” Between 1922 and 1929, the US grew an average of 5.7% annually—impressive given Western Europe eked out not quite 3% during the same period. China’s been even more impressive, expanding nearly 10% a year, on average, since 2005; advanced economies averaged only 1.5%.

- Boundless optimism. Amidst all of America’s new wealth and innovation, a lively consumer culture blossomed. The prospect that rising wealth and consumer credit would put automobiles, record players, and other new big-ticket purchases within reach made the US’s future growth seem certain. Many believe that China’s emerging middle class will drive a similar consumption bonanza (with the help of promised government reforms).

- Property boom-and-bust, easy credit. As economist John Kenneth Galbraith describes in The Great Crash, 1929, a Florida property bubble—and its subsequent burst—preceded the American stock frenzy that took hold later in the decade. In 1927, the Federal Reserve slashed rates, sending forth a gush of credit to be invested in stocks. China too has gone through a property bubble that began bursting in late 2013. The subsequent easing of credit since late 2014 sent the Chinese stock market rise into overdrive.

- Epic stock market surge. These rosy prospects boosted confidence in the US’s stock market rally. Between 1885 and the 1929 peak, the Dow Jones Industrial Average more than tripled. As for China, at its zenith, the Shanghai Composite Index was more than twice what it had been just a year earlier.

- Margin trading rampage. An explosion of leverage inflated US stocks even more. Brokerages lent out to small-time investors on margin, allowing them to buy only a small percentage of their stock trades with their own money—and letting them pocket outsized profit when they sold. Margin finance has been driving the rallies in Shanghai and Shenzhen as well. As share prices—and the collateral, therefore—have risen in value, borrowers can take out even more credit.

- Investment trusts abound. The other major leverage factor in 1920s America was the emergence of investment trusts, newfangled financial institutions that didn’t actually do anything besides hold stock in other companies—something called “pyramiding,” as economist John Kenneth Galbraith explained in 1987. This multi-layered shareholding amplified gains (and, eventually, magnified losses). China certainly has its share of complicated trusts “pyramiding” funds into the stock market.

- Rescue efforts. Even though the stock market officially crashed in October 1929, it suffered an alarming minor collapse in March of that year too. In both instances, corporate barons stepped in to stabilize the market and prevent margin calls from compounding the selloff. The first instance—when Charles E. Mitchell, head of National City Bank, announced that the bank would loan up to $25 million to the call market—halted the March slide. However, an October effort by a coalition of bankers to prevent a collapse by buying up shares of big companies failed. Both approaches are similar to what the Chinese government has undertaken to stop the mid-June crash from triggering margin calls.

Japan, 1989

China’s stock market clearly has a lot in common with the late 1920s American bubble. However, the Chinese economy has even more in common with pre-crash Japan’s, as we explored in more detail in an article last year:

- Investment-led growth model. Japan’s economic miracle relied on a system that forced Japanese savers to subsidize industrial expansion on the cheap. The suppressed consumption that resulted gave rise to an export boom that boosted industrial profits. However, the moral hazard of cheap money caused an explosion in debt and a buildup of more factory capacity than the economy really needed. The Chinese government has closely mimicked Japan’s model, suppressing consumption, and subsidizing borrowing by industrial companies in state-prioritized sectors even more. In the wake of global financial crisis—when China’s leaders launched a 4 trillion yuan ($586 billion in 2008 dollars)—these imbalances widened further. That’s made China even more dependent state-led industrial investment—and, therefore, on debt—to the economy growing.

http://atlas.qz.com/charts/414fhHDt - State dominance. In Japan, the government’s agenda heavily influenced what industries and companies got loans. Part of the scaffolding of that policy was built with “relationship banking,” the cozy, long-term lending relationships between certain banks and certain companies. That was reinforced with cross-shareholding of each other’s stocks. Many pundits of the day assumed that a stock crash was next to impossible because the network of big state-affiliated companies making up “Japan Inc.” would step in and buy, according to Wood. A major share of China’s stock market is made up of state-owned companies with similar overlapping investments. The heavy role of state companies in halting China’s stock crash in late June and early July reveals a similar close-knittedness.

- The perils of the “land standard.” Bank lending was the chief source of finance in the Japanese economy. But loan officers seldom estimated future cash flow to decide credit-worthiness. Instead, property was widely used as collateral for bank loans. In his book The Bubble Economy, Christopher Wood estimates that 80% of bank lending was directly or indirectly tied up in real estate—so much so that he says Japan effectively operated on a “land standard” the way the US and other countries in the 1920s tied their currencies to gold. Loans issued with property as collateral often went back into developing still more property—blowing the real estate bubble all the bigger, while also driving economic growth that boosted overall confidence. That makes property values critical to the flow of credit—and leaves bank balance sheets vulnerable to drop in values. Chinese banks operate in much the same way; in China today, 40% of bank loans are secured with property as collateral, according to the ratings agency Fitch. Indirectly, three-fifths of outstanding credit in China is exposed.

- Crumbling corporate profits. Toward the tail end of the stock bubble, more and more profit increases of Japanese companies came from gains in cross-owned stock. China today has experienced something similar, with the bulk of corporate profits coming from stocks.

By late 1989, Japanese stocks accounted for half of the planet’s entire stock-market capitalization. Real estate was similarly out of control; Japanese real estate was worth nearly half the world’s total land value. The central bank hiked interest rates suddenly, hoping to lightly chill the markets. The stock market began tanking. Real estate prices soon followed. The financial crisis that resulted lasted until the mid-2000s, during which seven banks were nationalized. The losses ultimately borne by Japanese taxpayers totaled at least 20% of Japan’s 2004 GDP. More than 25 years later, Japan is still struggling to emerge from its “lost decades” of stagnating growth.

Recipe for a Great Depression

Stock market crashes don’t always cause depressions—or, for that matter, lost decades. To understand why the US entered the Great Depression and Japan stagnated for two–plus decades, it helps to turn to the work of Yale economist Irving Fisher.

Two things tip a country from recession into depression, according to Fisher: too much debt, and the way dealing with that debt pushes down prices (i.e. deflation). The US messed up by failing to counteract falling prices by freeing up money—in fact, it catastrophically raised interest rates in the immediate wake of the 1929 crash.

When deflation sets in, falling prices cause the relative cost of debt to rise. That sinks debtors in even deeper, and makes would-be borrowers unwilling to take out loans to build their businesses. As people desperately sell off assets to pay back what they owe, they drive prices down even further—exactly what happened in the Great Depression. Unemployment surged to a quarter. More than 5,000 banks failed, taking with them untold sums of household wealth. It wasn’t until 1939 that the US truly emerged from the Great Depression.

Japan made a different mistake

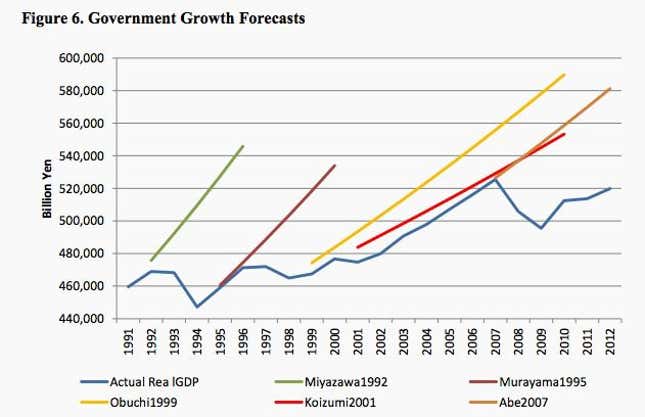

Japan avoided a depression after its stock crash—and the property market collapse that followed—by furiously expanding money supply and by ramping up government stimulus to replace vanished demand. So why is it still struggling to escape from its “Lost Decades”?

Bureaucrats and bankers believed that with enough time and loose money, they could grow out from under the debt burden.

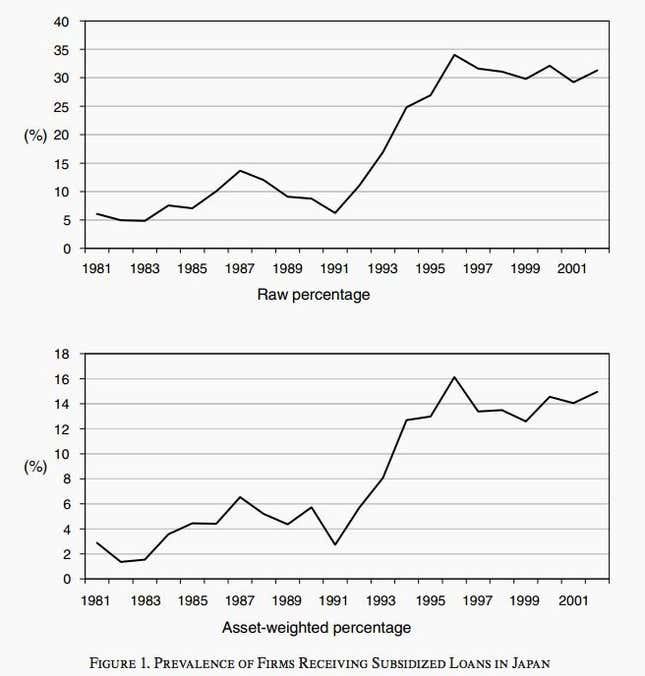

But Japan had too much debt for that approach to work. Loose money only went to keep broke companies alive—a phenomenon called “zombies”—instead of funding productive investment that might spur the economy. The chart below shows the percentage of bank customers whose loans were being rolled over. By the late 1990s, around 30% were being kept alive by this subsidized credit:

On top of that, by investing so heavily in industry, Japan built itself the capacity to churn out far more goods than anyone actually wanted to buy. The trouble isn’t just that money could have been spent better building the means to make things people truly wanted. It takes a long time for a factory to need replacing. With enough industrial capacity to last it for many years—even decades—Japan had few other options in which to profitably invest. Fiscal stimulus couldn’t make Japanese industry more productive, therefore. So as Japan waited a decade for growth to kick in once again, its debt pile mushroomed even more.

The lesson Japan failed to master is that too much debt makes it near-impossible to grow—and that the only way to get rid of that burden is therefore to recognize losses.

Whereas in the Great Depression, lots of companies and banks went bust, in 1990s Japan, hardly any did. America’s bankruptcy epidemic destroyed huge sums of wealth and, as a result, damaged the economy. But it also cleared away debt problems, preparing the country to borrow, invest, and grow again. While the Great Depression lasted just shy of a decade, Japan’s debt woes haunt it to this day, more than 25 years after its stock crash. Much of it’s simply shifted onto the Japanese government’s balance sheet. The threat of deflation still looms.

What’s next for China?

The growth-obsessed Chinese government is clearly going to do everything to prevent a Great Depression—which, at least in the short term, is good news for the global economy.

What’s worrisome, though, is the longer term. Along with the recent stock market bailout effort, aggressive credit loosening, revived infrastructure stimulus, and a steadfast refusal to let companies fail signals that the Chinese government is planning to grow out from under its $30-trillion debt burden. That suggests that China’s leaders are already busy repeating Japan’s mistakes.